Evergold Delivers Broad Intercepts from GL1 Main Zone, Golden Lion Property, Northern B.C., Recaps 2020 Program, Plans 2021 Follow-up

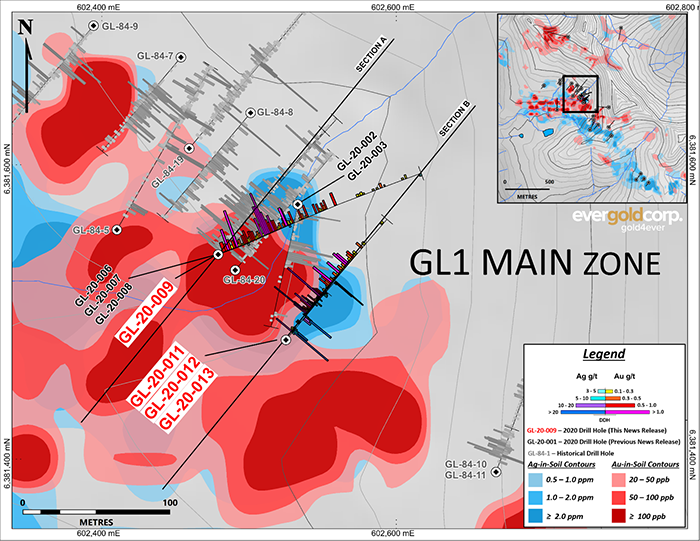

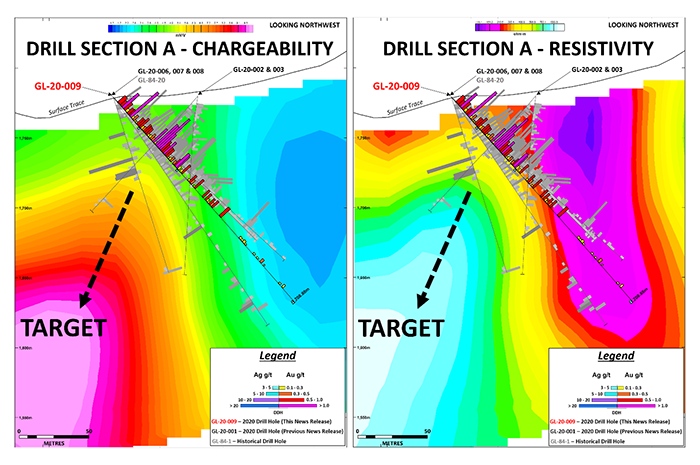

Toronto, Ontario – January 26, 2021 - Evergold Corp. (TSX-V: EVER, OTC: EVGUF, WKN: A2PTHZ) (“Evergold” or the “Company”) is pleased to report remaining results and recap the 2020 drill program on the Golden Lion property in northern B.C. Broad intervals of gold-silver epithermal style mineralization encompassing higher-grade intervals were intersected in step-outs to earlier reported holes. Inclusive of historical drilling by Newmont, the GL1 Main Zone now exceeds 800 metres in strike length. The zone comprises epithermal-style mineralization exposed at surface and associated with a geophysical response that increases with depth below current drill intercepts, suggesting that potentially stronger mineralization, and higher grades, may lie not far below. Evergold is excited to drill this underlying geophysical response in the approaching field season, within a broader program to evaluate extensions along strike.

GL1 Main – 2020 Drill Program Highlights:

- (New) 88.62 metres at 0.71 g/t Au from 4.88 to 93.50 metres in hole GL-20-009

- Including 16.50 metres of 1.59 g/t Au from 45.00 to 61.50 metres

- Including 10.50 metres of 2.07 g/t Au from 48.00 to 58.50 metres

- (New) 73.5 metres of 0.44 g/t Au from 29.51 to 103.01 metres in hole GL-20-011

- 53.21 metres at 0.75 g/t Au from 7.52 to 60.73 metres in hole GL-20-002*

- Including 19.00 metres of 1.61 g/t Au from 35.10 to 54.10 metres

- 73.82 metres of 0.50 g/t Au from 5.38 to 79.20 metres in hole GL-20-003*

- Including 7.60 metres of 2.78 g/t Au from 55.40 to 63.00 metres

- 61.70 metres of 0.76 g/t Au from 6.80 to 68.50 metres in hole GL-20-006*

- Including 17.50 metres of 1.51 g/t Au from 42.50 to 60.00 metres

- 73.12 metres of 0.69 g/t Au from 4.88 to 78.00 metres in hole GL-20-008*

- Including 8.39 metres of 1.72 g/t Au from 27.70 to 36.09 metres

*Previously released holes included for comparative purposes and to demonstrate the hole-to-hole consistency of results form the GL1 Main Zone.

“The GL1 Main Zone is wide, long, shallow, and appears from the geophysics to run deep,” said Kevin Keough, President & CEO. “The grades achieved in drilling to date, coupled with the near-surface position of the mineralization and moderate topography of the site, provide early indications of this zone being a potential bulk tonnage candidate, possibly including a high-grade component. Moreover, the strengthening character of the combined chargeability and resistivity response with depth, along with hints from trace element geochemistry, suggest drilling to date has tested only the upper levels of the system, holding promise for better grades below. It will not take us long, nor many holes, to test this hypothesis, and we look forward to doing so in the coming field season.”

Discussion of Drill Results – GL1 Main Zone Holes (Refer to Figures)

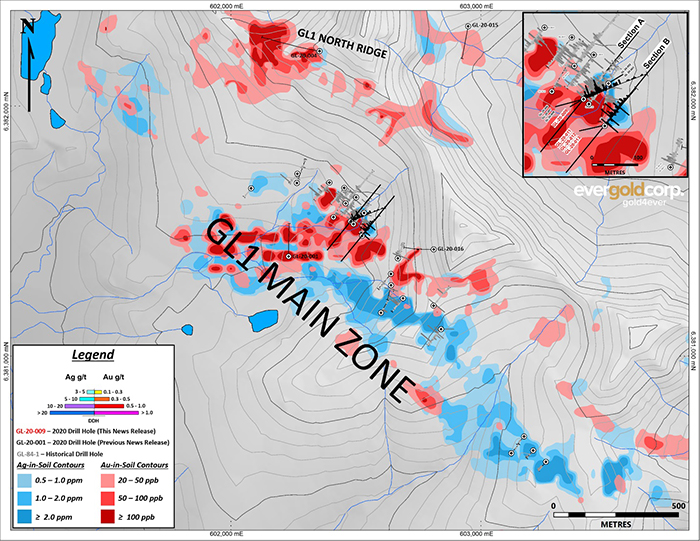

Drilling at the GL1 Main target indicates a broad, steeply dipping, northwest-southeast trending, gold-silver, quartz-carbonate, low sulphidation epithermal vein system displaying relatively consistent grades and excellent continuity hole-to-hole. The gold and silver bearing system has been intersected in 17 historical (1984) Newmont drill holes, and in all nine Evergold holes from 2020 targeted directly on the GL1 Main trend. Modelling of the Evergold results coupled with the historical Newmont drilling indicates the true width of the GL1 Main Zone exceeds 100 metres. From Newmont hole GL-84-21 in the northwest, to Newmont holes GL-84-16 and GL-84-17 in the southeast, the GL1 Main Zone is presently interpreted to encompass more than 840 metres of strike length in two sub-parallel trends, which remain open to the northwest, southeast, and to depth.

The intercepts reported today for drilling directly on the GL1 Main Zone are from four holes (GL-20-009, 011, 012 and 013), drilled from two drill setups, as discussed below. All holes were relatively shallow angle holes, ranged between 64 and 209 metres in length, and were drilled at dips of between -45 and -65 degrees. Hole GL-20-016, a longer, steeper hole than most at 325 metres and -70 degrees, was collared somewhat off-trend and drilled back toward GL1 Main from a third pad located well up-ridge to the southeast.

Hole GL-20-009 was drilled to a northeast azimuth (070 degrees) from the same pad as previously reported holes GL-20-006, 007, and 008 (all three holes drilled 040 degrees). Holes GL-20-011, 012 and 013 were also drilled to a northeast azimuth (040 degrees) from a second pad located 75 metres southeast of hole GL-20-009. Hole GL-20-016 was drilled to a southwest azimuth (255 degrees) from a pad located approximately 290 metres southeast of the pad or holes GL-20-011, 012 and 013, and 179 metres higher in elevation.

Notably, with the exception of hole GL-20-016, all holes drilled directly on the GL1 Main Zone during the 2020 exploration season cased into mineralization at surface and all holes carried intermittent gold and silver values down-hole well beyond the significant intercepts cited, and did not fully exit the GL1 Main Zone at depth.

The broad and consistent gold grades yielded in the holes drilled on the GL1 Main Zone to date are characterized by relatively low abundances (2 to 10 veins per metre) of narrow (generally less than 1 cm) and sulphide-poor epithermal quartz-carbonate veins and vein-breccias containing localized aggregates of galena and subordinate sphalerite and chalcopyrite. The highest-grade sections also contain rare semi-massive to massive quartz-carbonate sulphide veins and vein-breccias dominated by galena and lesser sphalerite. The best gold and silver grades are associated with silica, clay and pyrite (1 to 5%) alteration, giving the wallrock a pinkish hue.

Discussion of Drill Results - Reconnaissance Holes

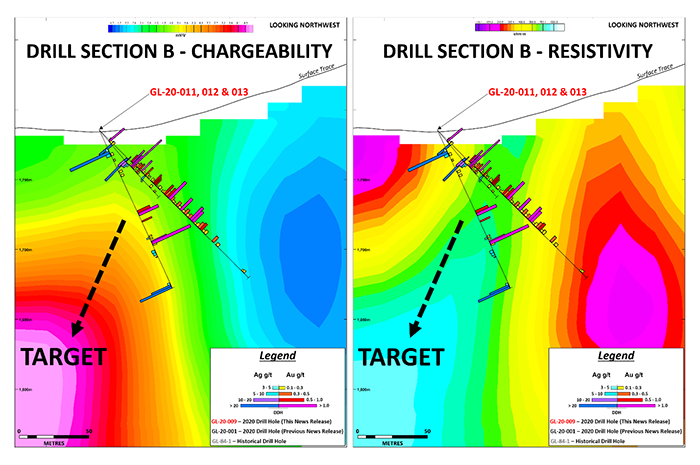

The geological fertility of the wider Golden Lion property beyond the GL1 Main Zone proper was made apparent by several rounds of geochemical soil and rock sampling, and mapping, carried out by Company personnel in 2018 and 2019. This work identified precious and base metal values in soil and in some cases in outcrop, which were deemed sufficiently compelling to warrant drill testing. These ‘wider property’ anomalies were grouped into three broad target areas: ‘GL1’, comprising the ‘GL1 Main Zone’ and ‘GL1 North Ridge’ prospects; ‘GL2’, located to the northeast of GL1 and comprising the ‘GL2 Skarn’, ‘GL2 Ridge East’, ‘BG’, and the ‘EP’ prospects; and the ‘GL3’ target area, located southeast of GL2 and east of GL1.

During the 2020 program, the Company conducted additional sampling and mapping of several of these prospects, and induced polarization surveys over all of them. However, due to time limitations, only three of the known prospects and one that emerged during the season, were tested with the drill: GL1 North Ridge (hole GL-20-004), the GL2 Skarn (holes GL-20-005 and 014) and EP (hole GL-20-015) prospects, and the GL3 ‘8300’ prospect (hole GL-20-010). Of particular significance, a narrow intercept of chalcopyrite-bearing massive sulphide mineralization with strong copper-gold-silver values was returned from hole GL-20-014, along with a hint of similar potential in hole GL-20-005, located 200 metres northeast of GL-20-014. This mineralization is hosted by intrusive rocks and limestones, suggesting that good potential exists for porphyry- and skarn- or replacement-style mineralization on the GL2 target area.

Hole GL-20-001 was drilled due north from a pad located approximately 250 metres southwest of the GL1 Main Trend. The purpose of this hole was to test below a strong east-west trending precious metals soil geochemical anomaly. The anomaly was tested after an IP survey identified a high resistivity anomaly associated with the favourable geochemical trend. Although no significant gold or silver assays were returned, arsenic values accompanied by antimony were seen to be elevated in core well above background, something to be expected distal to an epithermal system. As shown on the two accompanying cross-sections (Figures 3 and 4), geophysical work at GL1 Main indicates potential system strengthening down to the west in the direction of hole GL-20-001 which if true, may suggest the As and Sb values seen in hole GL-20-001 do indeed reflect leakage from the system below.

GL1 ‘North Ridge’ hole GL-20-004 was drilled in a northwesterly direction below a strong gold-in-soil anomaly developed by the Company in 2019, including impressive highs in sequential sampling to 14.95 g/t Au along the spine of GL1 North Ridge, about 800 metres to the north of GL1 Main. This hole was sampled, but not assayed since other holes were considered higher priority. Hole 004 samples were left on site anticipating planned continuance into a 2020 Phase 2 drill program, which did not happen due to delays in receiving assay results. Additional soil sampling carried out in September 2020 over the target area confirmed the strong tenor of the gold anomaly and expanded it downslope to the north and south, making hole 004 of greater interest in this context. Review of logs and core photos indicates the presence of veining and fine sulphides. Samples will be submitted for assay in the 2021 field program.

GL2 Target Area hole GL-20-005 was drilled to a northwest azimuth to test a strong IP chargeability anomaly 200 metres along strike to the northeast of the outcropping “GL2 Skarn” target, later tested by hole GL-20-015 (below). No significant gold or silver values were returned. The chargeability high was explained by disseminated, fine-grained pyrite, pyrrhotite and rare chalcopyrite hosted in intrusives and (similar to hole GL-20-014 below) brecciated limestone.

GL2 Target Area hole GL-20-014 was drilled to the northwest to test below the GL2 Skarn target, which in previous outcrop sampling had returned high values of copper with associated strong silver and gold, including 13.5% Cu, 122 g/t Ag, and 0.146 g/t Au in GLAA18-036R. A 1-metre intercept of chalcopyrite-rich sulphides hosted within brecciated limestone between 44.36 and 45.36 metres returned an encouraging 3.66 g/t Au, 33.89 g/t Ag, and 3.34% Cu.

GL2 ‘EP Zone’ hole GL-20-015 was drilled to the south/southwest to test below high-grade porphyry and epithermal-style samples collected from outcrop, including sample no. GLVB18-031R, which assayed 3,180 g/t Ag and 18.4 g/t Au, and sample GLAA18-026R, which assayed 2.1% Cu, 10.7 g/t Ag, and 0.70 g/t Au. No significant assay results were returned, possibly due to hole orientation. However, additional work on this prospect is justified as mapping suggests a significant stockwork vein zone hosted within intrusive rocks.

GL3 Target Area ‘8300 Prospect’ hole GL-20-010 was drilled to a northeast azimuth to test a strong IP chargeability anomaly below visible alteration on surface. No significant gold or silver values were returned. The chargeability high was explained by disseminated, fine-grained pyrite hosted in volcaniclastics. The GL3 ‘Main’ target, which is separate from the 8300 prospect, has not yet been drill tested.

Next Steps

With drill results mostly completed for the 2020 exploration program, Evergold is crafting specific drilling and related exploration activities for the approaching field season at both Golden Lion and Snoball.

About Evergold

Evergold Corp. has been assembled by a team with a record of recent success in British Columbia, combining four 100%-owned properties in prime B.C. geological real estate from well-known geologist C.J. (Charlie) Greig, with the recently optioned Rockland property in Nevada, seasoned management, and a qualified board. The Company’s flagship assets consist of the Snoball property, located in the heart of BC’s famed Golden Triangle, where drilling in 2020 achieved the discovery of a new high-grade intrusion-related gold-silver system on Pyramid Peak; the Golden Lion property, located at the north end of B.C.’s Toodoggone region, where drilling in 2020 confirmed the presence of a large-scale epithermal-style gold-silver zone at the GL1 Main prospect; and the past-producing high-grade Rockland gold-silver property in Nevada. All three of these properties host discoveries and/or zones of precious metals that the Company believes offer considerable near-term upside.

On Behalf of Evergold Corp.

“Kevin M. Keough”

President & CEO

For further information please visit the Evergold Corp. website at: www.evergoldcorp.ca or contact:

Kevin Keough

President and CEO

Tel: (613) 622-1916

[email protected]

QA/QC:

Andrew J. Mitchell, P.Geo., Vice President, Exploration for Evergold Corp. and a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information in this news release.

Samples of NRQ (7.576 cm) - diametre drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and half placed back in the original core box for permanent storage. Sample lengths for holes in this release average 1.51 metres, and typically vary from a minimum 0.6 metre interval to a maximum 2.29 metre interval. Drill core samples were flown from camp to Smithers then delivered by truck in sealed woven plastic bags to the MSA Labs preparation facility in Terrace, BC, with final analysis at the MSA analytical laboratory in Langley, BC. The MSA Labs facilities are accredited to the ISO/IEC 17025:2017 and ISO 9001:2015 standards. Gold was determined by fire-assay fusion of a 50 gram sub-sample with atomic absorption spectroscopy (AAS). Various metals including silver, gold, copper, lead and zinc are analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. Both the Company and MSA Labs have robust QA/QC program that includes the insertion of blanks, standards and duplicates.

Table 1. Golden Lion Drilling – Significant Intercepts

For hole locations, dips and azimuths, please refer to the table below and accompanying drilling plan views (Figures 1 and 2) and drill sections (Figures 3 and 4). Widths reported are drilled core lengths. True widths for individual holes targeting the GL1 Main Zone are not presently known as the GL1 Main Zone dip has not been determined. However, true widths for the GL1 Main Zone as measured perpendicular to apparent strike appear from modelling to well exceed 100 metres. True widths for reconnaissance holes GL-20-004, 005, 010, 014 and 015 are unknown, as there has been insufficient drilling to determine them.

| Drill Hole | Az | Dip | From (metres) |

To (metres) |

Length (metres) |

Au (g/t) |

Ag (g/t) |

| GL1 MAIN ZONE HOLES | |||||||

| GL-20-009 | 070 | -45 | 4.88 | 93.50 | 88.62 | 0.71 | 0.89 |

| Including | 45.00 | 61.50 | 16.50 | 1.59 | 0.95 | ||

| Including | 48.00 | 58.50 | 10.50 | 2.07 | 0.98 | ||

| Including | 48.00 | 55.50 | 7.50 | 2.53 | 0.87 | ||

| Including | 48.00 | 54.00 | 6.00 | 2.92 | 0.88 | ||

| GL-20-011 | 040 | -45 | 29.51 | 103.01 | 73.50 | 0.44 | 0.87 |

| GL-20-012 | 040 | -50 | 10.30 | 14.80 | 4.50 | 0.51 | 9.99 |

| And | 33.17 | 42.17 | 9.00 | 0.61 | 1.01 | ||

| GL-20-013 | 040 | -65 | 64.00 | 91.60 | 27.60 | 0.58 | 0.80 |

| Including | 87.85 | 90.60 | 2.75 | 3.42 | 2.30 | ||

| GL1 MAIN ZONE – OFF TREND HOLES | |||||||

| GL-20-016 | 255 | -70 | 173.50 | 190.15 | 16.65 | 0.13 | - |

| RECONNAISSANCE HOLES | |||||||

| GL-20-001 | 0 | -45 | NSI1 – but elevated As and Sb | ||||

| GL-20-004 | 280 | -45 | To be assayed during 2021 program | ||||

| GL-20-005 | 315 | -45 | NSI | ||||

| GL-20-010 | 040 | -65 | NSI | ||||

| GL-20-014 | 230 | -45 | 44.36 | 45.36 | 1.00 | 3.66 | 33.89 |

| GL-20-015 | 190 | -45 | NSI | ||||

- No significant intercepts

- Also returned Cu = 3.34%

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, an inability to complete the second tranche of Offering on satisfactory terms or on the timeline as announced or at all and the expected expenditure of the proceeds of the second tranche of the Offering; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restrictions on labour and international travel and supply chains, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Figure 1. Plan View – Drilling on Geochemistry & Topography – Wider Golden Lion Property

Figure 2. Plan View - Drilling on Geochemistry & Topography, GL1 Main Zone Close-Up

Figure 3. Section View – Drilling on IP Chargeability & Resistivity, GL1 Main Zone

Figure 4. Section View - Drilling on IP Chargeability & Resistivity, GL1 Main Zone